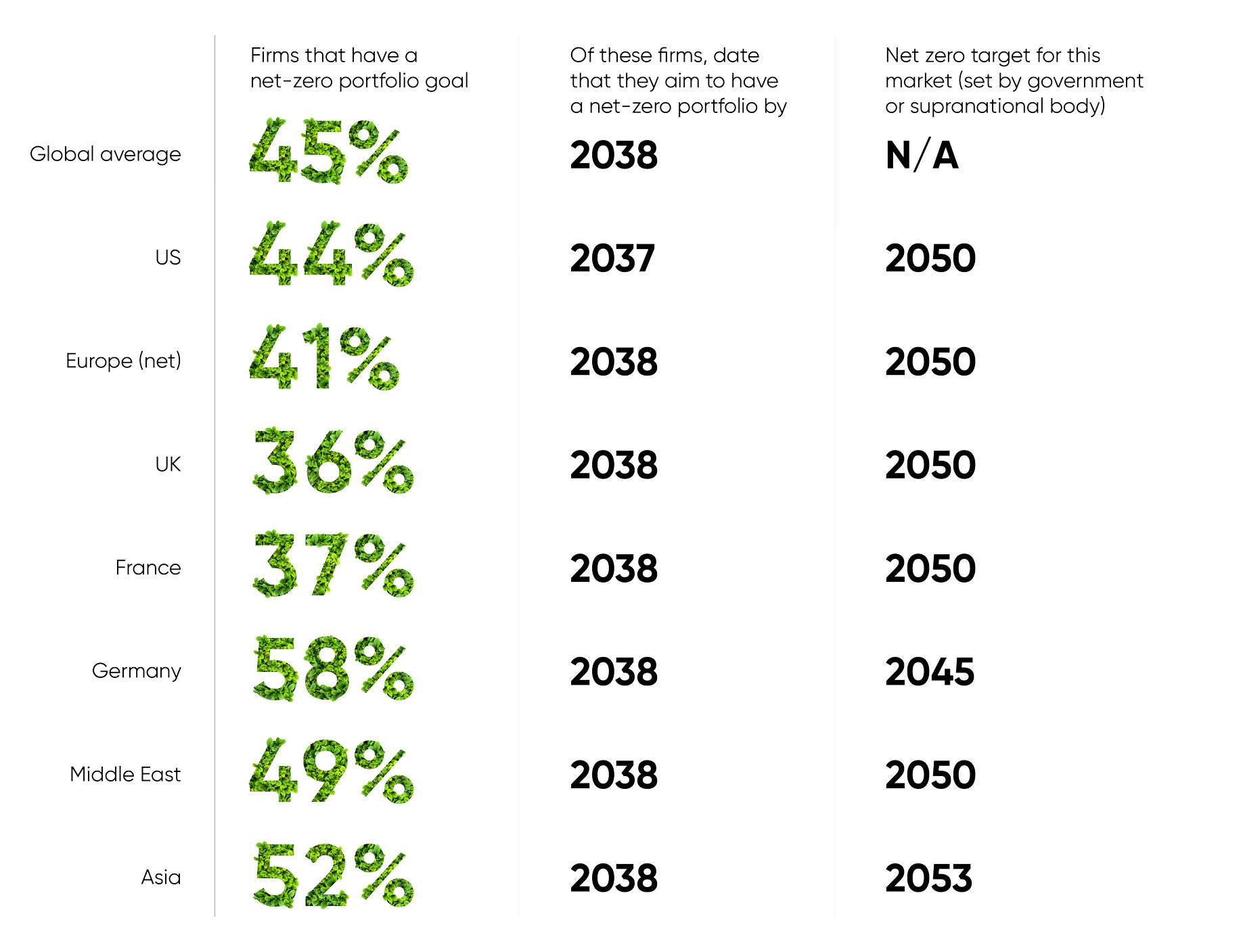

Although investors clearly recognize the Real Estate Investment Imperative and almost all firms are making efforts to reduce the energy intensity of their property portfolio, our global study reveals that only 45% of real estate investors are aiming to achieve a net zero property portfolio – dropping to just 36% of UK firms. On average, firms that do have a net-zero portfolio goal aim to achieve this by 2038, 15 years away.

Although decarbonization makes business sense and long-term financial sense, at a time when the market is struggling and interest rates are high, it is difficult for investors to take decisive action in the short term.

Net Zero Commitments

Although investors clearly recognize the Real Estate Investment Imperative and almost all firms are making efforts to reduce the energy intensity of their property portfolio, our global study reveals that only 45% of real estate investors are aiming to achieve a net zero property portfolio – dropping to just 36% of UK firms. On average, firms that do have a net-zero portfolio goal aim to achieve this by 2038, 15 years away.

Although decarbonization makes business sense and long-term financial sense, at a time when the market is struggling and interest rates are high, it is difficult for investors to take decisive action in the short term.

Looking ahead

By 2030 – the milestone by which global emissions need to be reduced by approximately 50% to keep to the Paris Agreement aim of limiting global warming to 1.5 degrees Celsius (2.7 degrees Fahrenheit) – firms believe that over half of their property portfolio (55%) will still be made up of real estate assets that have unknown, poor or average sustainability performance.

Although firms do expect to increase the proportion of their portfolio that meets good sustainability standards between now and 2030, they still believe a significant proportion of their portfolio will be of unknown/poor/average standard by this date.

This points to a worsening dislocation in the market over the next seven years, as almost four in five (79%) corporate occupiers say that by 2030 the sustainability of a building will be the most important factor in the rental decision-making process for their organization. What will happen to sub-par real estate that falls short of sustainability thresholds and fails to attract tenants, but is prohibitively expensive to upgrade? The private equity and institutional investors in our study state that, of their assets that currently fail to meet basic sustainability standards, on average, 22% are not possible to retrofit and a further 23% are not economically viable to retrofit to meet higher standards.

European market spotlight

The Energy Performance of Building Directive (EPBD) – the main piece of EU legislation addressing decarbonization of buildings – is currently under revision, with the recast negotiations approaching their conclusion. Buildings are currently responsible for over a third of EU emissions and 40% of energy consumption. Currently, 75% of Europe’s buildings are classed as inefficient and will need to be upgraded by 2050 if the EU is to meet its net zero targets.

Our study shows that although Europe is setting precedents in terms of sustainability legislation, European investors’ attitudes do not necessarily match. Although European firms in our study (based in the UK, France and Germany) are more likely than firms from any other region to say they have a public commitment to sustainability, they are the least likely to say they are actually factoring sustainability into their day-to-day decision-making: 68% of European investors say that sustainability performance is an important factor to their firm when making real estate investment decisions, compared to 84% of US investors and 83% of firms based in the Middle East.

Corporate tenants' sustainable real estate strategies and policies, strategies and decision-making

Many investors also have public policies and goals, but our study shows that it is lower on their agenda. Under half of investors have an agreed, firm-wide definition of ‘sustainable real estate’, compared to over 60% of corporate tenants that have an agreed definition, and less than a quarter of investment firms (23%) have specific, measurable sustainability goals.

Markets now need to find a way to reach the ambitious goals that have been set.

Dr Thomas Prüm

Partner

Sustainability strategies and policies

The question of who bears the cost and responsibility for more sustainable real estate is a challenging one, but our study makes it very clear that corporate tenants are incorporating sustainability into their real estate policies, strategies and decision-making.

Fons van Dorst, Executive Managing Director UK at real estate developer EDGE, said:

“Organizations – especially the larger ones – are under scrutiny. They do a lot of reporting and need to explain their carbon footprint. They can make incremental changes to their operations, but if they want to make a statement and a bigger impact, it makes sense to choose a more sustainable office building. It is one of the most visible parts of the brand, and it is also the embodiment of the brand itself.

“But alongside this external pressure, there is also a lot of internal pressure. An organization’s sustainability credentials are critical for attracting and retaining the best talent, especially amongst a purpose-driven younger generation; they want to identify themselves with corporate brands that reflect their personal ethos and values.”

Corporate tenants' sustainable real estate strategies and policies, strategies and decision-making

Many investors also have public policies and goals, but our study shows that it is lower on their agenda. Under half of investors have an agreed, firm-wide definition of ‘sustainable real estate’, compared to over 60% of corporate tenants that have an agreed definition, and less than a quarter of investment firms (23%) have specific, measurable sustainability goals.

Investors need reassurance that regulation will stay consistent to encourage further investment in sustainability-focused projects.

Henry Ranchon

Head of Real Estate France at BCLP

The EU’s Sustainable Finance Disclosure Regulation

The EU Sustainable Finance Disclosure Regulation (SFDR), introduced in March 2021, aims to make the sustainability profile of financial products clearer to enable informed investment decisions. It sets out three classifications for investment funds and mandates: Article 6, Article 8 and Article 9.

Article 6 funds do not integrate any sustainability considerations and must be clearly labeled as non-sustainable. Article 8 funds promote environmental or social characteristics, provided that the invested companies follow good governance practices. Article 9 funds must have sustainable investment as their objective.

The regulation aims to encourage transparency and prevent greenwashing. However, in practice, classifying funds is difficult – some of the regulation’s wording is ambiguous and different asset managers use different methods of categorizing funds. Some funds with similar characteristics are being classified differently, stoking the greenwashing debate that the regulation was intended to stifle. Article 8 is becoming a broad category, home to many different asset types with diverse approaches to ESG – for some of these funds, ESG considerations are just ‘included’ in investment decisions.

In early 2023, Level 2 of the SFDR was implemented, forcing asset managers to provide detailed disclosures about their funds’ ESG approaches, with stricter obligations for Article 8 and 9 funds. Ahead of this, many investors downgraded “Article 9” funds to Article 8.

BCLP in Practice

Companies should be acting now to put structures in place relating to their environmental approach to more sustainable real estate. Credible plans and policies are needed to demonstrate how they are responsibly managing the environmental performance of their real estate holdings to satisfy reporting and disclosure requirements. Navigating the slew of legislation and regulatory measures that have emerged across multiple jurisdictions in recent years makes this more challenging.

Our unrivalled knowledge and experience in the real estate sector means we are at the forefront of these legislative changes, and we can advise on how these will impact you and your real estate portfolio.

The Sustainable Finance Disclosure Regulation (SFDR) will apply to real estate entities such as real estate funds which are publicly advertising financial products within the EU, as well as alternative investment fund managers and investment firms or credit institutions providing real estate portfolio management within the EU. The regulation does not directly require the making of sustainable investments. The obligation is to provide information and to disclose sustainability-related information on real estate investments. However, the broad availability of standardized sustainability information leads to an increase in the demand for more sustainable financial products, including real estate-based products.

Whether you would like to know more about the EU regulations, how they will impact your value chain or if your offering documents are compliant, we can advise you on these regulations and put your mind at ease.

To discuss the impact of the SFDR please contact the BCLP team:

Related articles

Scaling up Sustainable Real Estate Investment

Insight report 3