Real estate is undergoing a global paradigm shift

To reduce emissions and limit temperature rises, business models and economies will need to adapt. Although real estate is just one facet of the complex sustainability challenge that the world faces, it is a critical one: nearly 40% of global carbon dioxide emissions come from the real estate sector. The footprint of commercial buildings has never been under more scrutiny. As businesses feel the pressure to reduce their environmental impact, ‘greening’ their real estate is one of the first levers that they reach for. And as many organizations reduce their office space, sustainability becomes a critical factor in the buildings they choose – and those they lose.

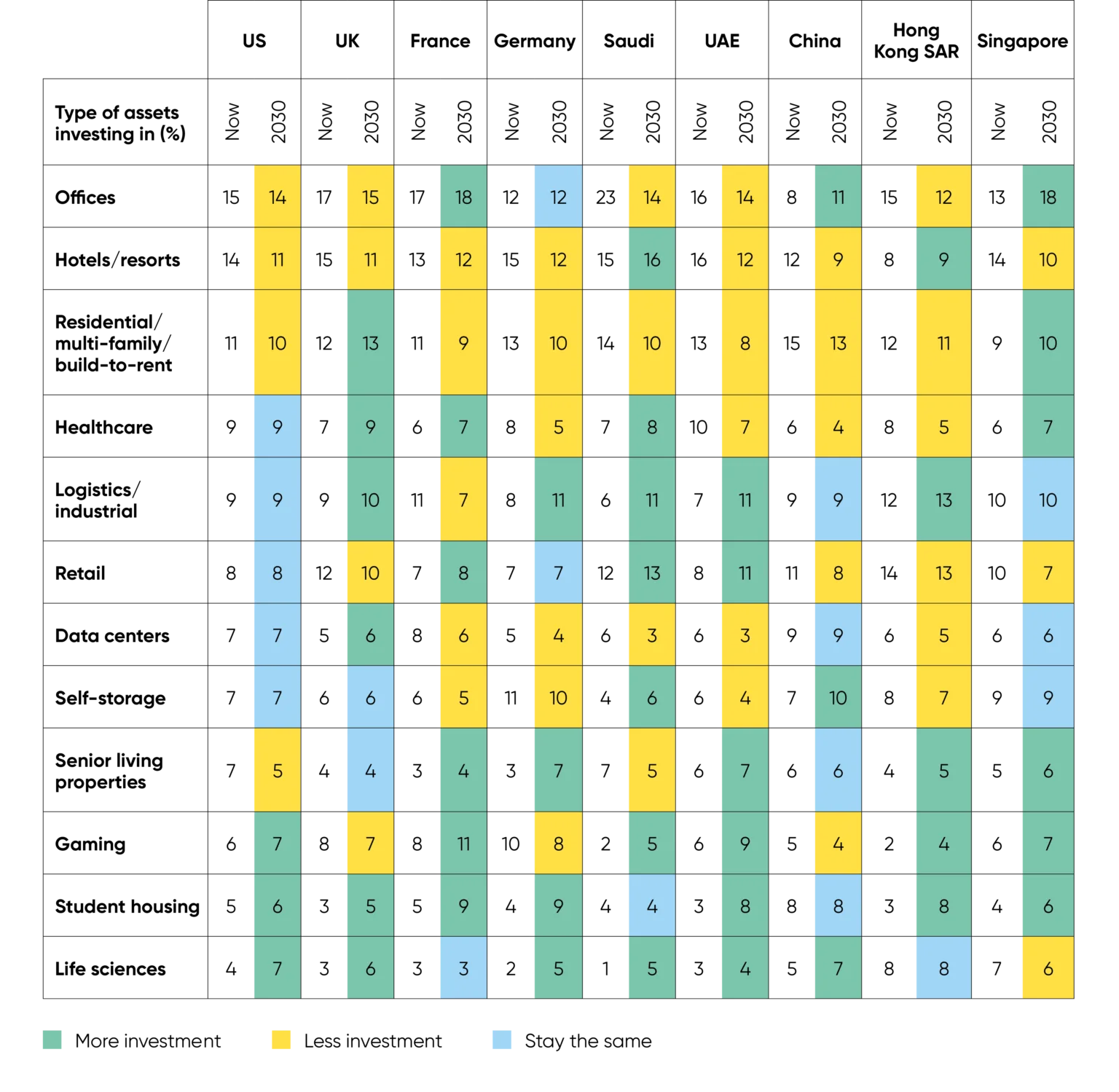

Commercial real estate is also being reshaped by other factors, including changes to working habits, exponential technology growth, macroeconomic forces including rising interest rates and inflation, and geopolitical conflict. The largest sector of commercial real estate, office space, is undergoing a huge change as demand and working patterns evolve, while previously marginal asset classes like data centers are attracting increasing attention from investors. Our data shows how many real estate investors are changing the makeup of their portfolios in response to market forces and changing demand. The investors in our global research plan to reduce their investment in offices in most focus markets between now and 2030. Meanwhile, investors expect to double their investment in life sciences assets in some countries, for example from an average of 3% of their total investment in UK real estate to an average of 6% by 2030.

At this critical inflection point, The Sustainability Imperative: The Future of Real Estate Investment– based on global research among real estate investors (private equity and institutional) and corporate occupiers – explores the sustainability imperative in real estate investment. It tracks the increasing divide between best-in-class real estate that meets high sustainability standards and properties that fall short of sustainability thresholds and suffer substantial discounts as a result.

Real estate investment between now and 2030 as a percentage of asset type investment

These dynamics and their impacts are not straightforward. As investors, businesses and governments consider the costs of decarbonization and the higher levels of capital needed to transition, they are reconsidering how they evaluate assets. The whole commercial real estate community has a significant role to play in shaping a low-carbon future, and this in-depth research examines corporate occupier and investor attitudes to that journey, and the key barriers and accelerators to a more sustainable future for the sector.

Read our latest global research insights

Insight report 1 – The Sustainable Real Estate Investment Imperative

Read our first report that reveals how the “green premium” is impacting commercial real estate values, with over 71% of investors expecting properties with strong energy performance standards to have a higher resale value than an equivalent property with lesser energy credentials. Sustainability is shaping the commercial real estate market.

Insight report 2 – From green intention to action

Both corporate occupiers and investors are aware of the sustainable real estate imperative, but closing the gap between intention and action is challenging – and expensive. Our study sheds light on an increasing dislocation in the market: 79% of corporate occupiers say that by 2030 the sustainability of a building will be the most important factor in the rental decision-making process for their organization, but investors believe that on average, over half of their property portfolio (55%) will still be made up of real estate assets that have unknown, poor or average sustainability performance by this date.

Insight report 4 – Benchmarking and best practice

Our study identified three key dimensions of sustainability-focused real estate investment that enable us to compare different regions and their progress towards greener portfolios. Read our report to find out how different regions are faring as they try to address the sustainability challenge.

Download the report here

Access the report now that tracks the increasing divide between best-in-class real estate that meets high sustainability standards and properties that fall short.

PERE keynote interview

BCLP’s Andrew Auerbach (Head of US Real Estate) and Kieran Saunders (European Head of Corporate Real Estate & Funds) discuss the sustainability imperative within real estate with leading publication PERE. Andrew and Kieran explore the factors driving sustainable building investment, both in Europe and the US, covering issues such as retrofitting, environmental standards and cost.

The key stories that emerged from our research are:

The sustainable real estate investment imperative

Our research shows that almost all corporate tenants are considering sustainability factors when making property rental decisions, and investors recognize the impact of the ‘green premium.’ But as sustainability standards rise, this green premium could give way to a ‘brown discount.’ On average, investors believe that 11% of their firm’s current real estate investment portfolio is at risk of being unsaleable due to failure to meet certain sustainability criteria. This amounts to an average of $442 million of investments at risk per firm.

From green intention to action

Both corporate occupiers and investors are aware of the sustainable real estate imperative, but closing the gap between intention and action is challenging – and expensive. Our research sheds light on an increasing dislocation in the market: 79% of corporate occupiers say that by 2030 the sustainability of a building will be the most important factor in the rental decision-making process for their organization, but investors believe that on average, over half of their property portfolio (55%) will still be made up of real estate assets that have unknown, poor or average sustainability performance by this date.

Scaling up sustainable real estate investment

The research identifies three key barriers to sustainable real estate investment: a lack of consensus (including definitions, certifications and data); the need for cultural change and organizational transformation; and the difficulty in bringing older buildings up to modern sustainability standards. We also explore some critical drivers to increasing investment, including greater standardization, government incentives and proptech.

Three dimensions of sustainable real estate investment

As part of our research, we identified three key dimensions of sustainability-focused real estate investment: firms’ strategy, appetite, and level of investment in green real estate. We then scored our investor respondents on each dimension, enabling us to map areas of strength and weakness on a global and market level.

About our research

The Sustainability Imperative: The Future of Real Estate Investment report is based on an independent, global opinion research study, and supplementary qualitative interviews with BCLP partners and industry thought leaders.